History

Sustaining excellence for almost 40 years takes more than just hard work. Wall Street Access has an entrepreneurial culture that has been instrumental in our ability to make a positive impact on our people, our clients and the industry since 1981.

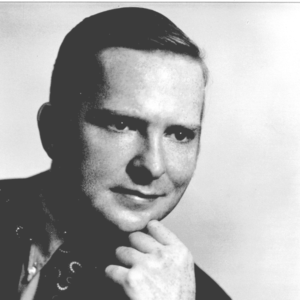

Inspired Leadership

Denis P. Kelleher founded Wall Street Access and provided the vision and leadership that enables the firm to evolve one step ahead of the market. Denis was the former President of Ruane Cunniff & Co., Inc., served as Vice President and Treasurer of the Sequoia Fund, and had a bold vision for Wall Street Access and its future.

1981

Denis P. Kelleher starts Wall Street Clearing Company, which specializes in wholesale execution and clearing of securities transactions. The company partners with Kansas City Southern Industries in this endeavor.

1990

The clearing business of Wall Street Clearing Co. is acquired by Alex Brown and Sons, which was later acquired by Deutsche Bank.

1990

The name of the firm was changed to Wall Street Investor Services to develop mutual fund marketing programs for banks and provide discount brokerage, retirement planning and professional money management services for investors.

1993

The company wins the exclusive endorsement of American Bankers Association to distribute investment products through ABA member banks.

1996

The company announces its new name– Wall Street Access – which reflects the dedication to providing superior execution and asset management services to high net worth individuals and institutions.

1996

Tom Burnett introduces the Merger Insight research product, which helps clients navigate the complexity of announced mergers and acquisitions that are greater than $500 MM.

1996

Wall Street Access featured in Barron’s first survey of “The Best Online Brokers” in 1996 and is included in each subsequent survey until the business was acquired by E*Trade in 2004

2001

DST Systems Inc. acquires an equity interest in Wall Street Access.

2004

Proprietary hedge fund of funds, Advanced Strategies II, LP is formed from a merger of VK Associates and Advanced Strategies I, LP.

2004

The retail online brokerage business was acquired by E*Trade in 2004

2006

The firm establishes a fixed income trading group, headed by Richard Lee which specializes in high-grade corporate bonds.

2012

Global Sales and Trading team, led by Dana Pascucci, joins from Rodman & Renshaw, adding market making capabilities to Wall Street Access for the first time in the firm’s history.

2013

Wall Street Access completes repurchase of DST Systems equity stake.

2015

Wall Street Access forms joint venture with technology-trading firm Global Liquidity Partners.

2017

Wall Street Access Asset Management partners with Starboard Advisors to further the growth of the wealth management business.

2018

Wall Street Access merges the business of Vandham Securities into its operations.

2018

Wall Street Access adds a fixed income trading group which includes certificates of deposit and municipal bond trading.